If you’re planning to sell this year, you’re probably thinking about what you’ll need to do to get your house ready to appeal to the most buyers. It’s crucial to work with a trusted real estate professional who knows your local market to get your home ready to sell. But there are a few things you should consider when deciding what to renovate and update before listing this season. Here are three things to keep top of mind as you’re making your list of projects to tackle this year.

1. The Number of Homes for Sale Is Very Low

Housing inventory sits far below what is normally considered a balanced market. In fact, according to the National Association of Realtors (NAR), the latest data indicates inventory is hitting an all-time low. Because there’s such a limited supply of homes available for sale, you’re in a unique position when you sell your house to benefit from multiple offers and a quick process.

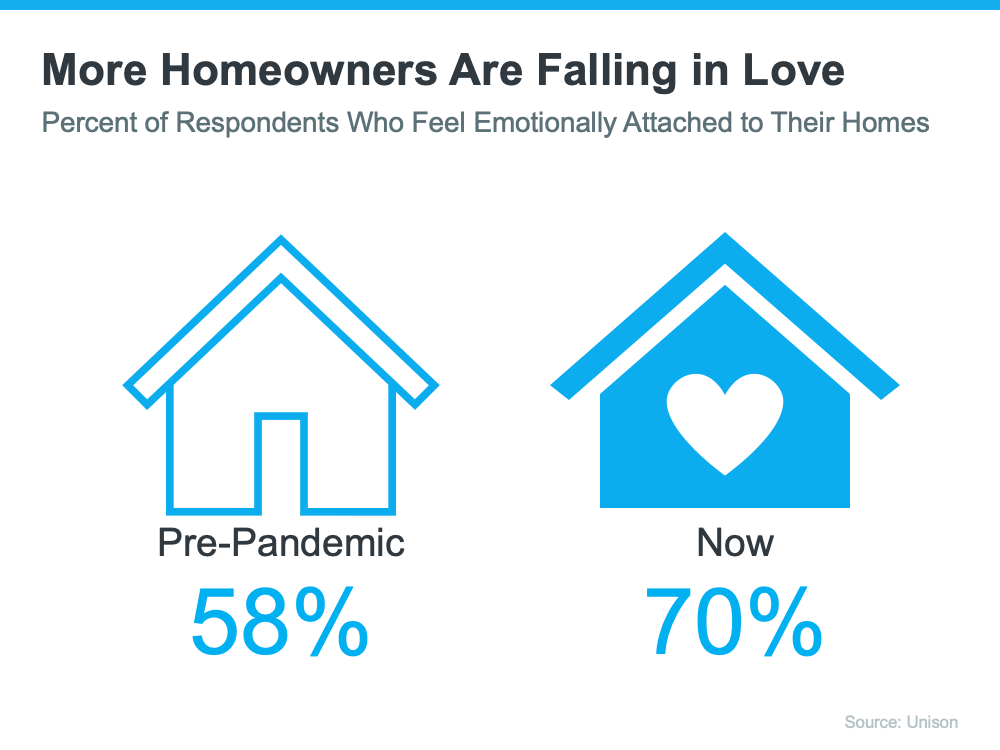

But you want to do so while buyers are still scooping homes up as fast as they’re being listed. Spending time and money on renovations before you sell could mean you’ll miss your key window of opportunity. Of course, certain repairs may be important or even necessary. The best way to determine where to spend your time – and your money – is to work with a real estate advisor to confirm which improvements are truly needed and which ones aren’t likely to be deal-breakers for buyers.

2. Buyers May Be Willing To Take on Projects When They Purchase Your House

Today, many buyers are more willing to take on home improvement projects themselves to get the house they’re after, even if it means putting in a little extra work. A recent survey from Freddie Mac finds that:

“. . . nearly two-in-five potential homebuyers would consider purchasing a home requiring renovations.”

If more buyers are willing to tackle repairs on their own, it may be wise to let the future homeowners remodel the bathroom or the kitchen to make design decisions that are best for their specific taste and lifestyle. Depending on the structural condition of your house, your efforts may be better spent working on small cosmetic updates, like refreshing some paint and power washing the exterior to make sure the home stands out. Instead of over-investing in upgrades, the buyer may change anyway, work with a real estate professional to determine the key projects to tackle that will give you the greatest return on your investment.

3. Your Agent Will Help You Spotlight the Upgrades You’ve Made

Over the past year, many people made a significant number of updates to their homes. The most recent State of Home Spending report finds:

“Home improvement spending rose 25% year-over-year to $10,341. Homeowners who invested in home improvement did an average of 3.7 projects, up from 2.7 in 2020, . . .”

With more homeowners taking on more projects in the past 12 months, there’s a good chance you’ve already made updates to your home that could appeal to buyers. If that’s the case, your real estate advisor will find ways to highlight those upgrades in your listing.

The same is true for any projects you invest in moving forward. No matter what, before you renovate, contact a local real estate professional for expert advice on what work needs to be done and how to make it as appealing as possible to future buyers. Every home is different, so a conversation with your agent is mission-critical to make sure you make the right moves when selling this season.

Bottom Line

In a sellers’ market like today’s, it’s important to spend your time and money wisely when you’re getting ready to move. Let’s connect today so you can find out where to target your efforts before you list.

![How To Win as a Buyer in a Sellers’ Market [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2022/02/10091313/20220211-KCM-Share-549x300.png)

![How To Win as a Buyer in a Sellers’ Market [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2022/02/10091231/20220211-MEM.png)

![How Remote Work Impacts Your Home Search [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2022/02/03134354/20220204-KCM-Share-549x300.png)

![How Remote Work Impacts Your Home Search [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2022/02/03134357/20220204-MEM.png)