A great way to ease some of those emotions and ensure you’re feeling confident in your decision is to keep these three best practices in mind.

1. Price Your Home Right

The housing market shifted in 2022 as mortgage rates rose, buyer demand eased, and the number of homes for sale grew. As a seller, you’ll want to recognize things are different now and price your house appropriately based on where the market is today. Greg McBride, Chief Financial Analyst at Bankrate, explains:

“Price your home realistically. This isn’t the housing market of April or May, so buyer traffic will be substantially slower, but appropriately priced homes are still selling quickly.”

If you price your house too high, you run the risk of deterring buyers. And if you go too low, you’re leaving money on the table. An experienced real estate agent can help determine what your ideal asking price should be.

2. Keep Your Emotions in Check

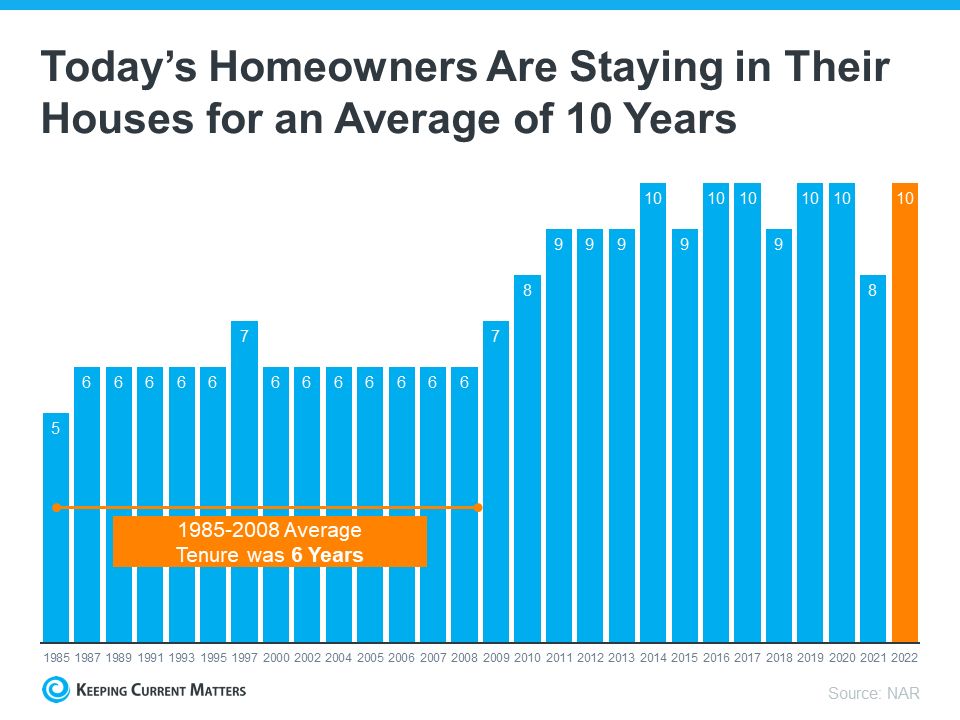

Today, homeowners are living in their houses longer. According to the National Association of Realtors (NAR), since 1985, the average time a homeowner has owned their home has increased from 5 to 10 years (see graph below):

This is several years longer than what used to be the historical norm. The side effect, however, is when you stay in one place for so long, you may get even more emotionally attached to your space. If it’s the first home you bought or the house where your loved ones grew up, it very likely means something extra special to you. Every room has memories, and it’s hard to detach from the sentimental value.

For some homeowners, that makes it even harder to negotiate and separate the emotional value of the house from fair market price. That’s why you need a real estate professional to help you with the negotiations along the way.

3. Stage Your Home Properly

While you may love your decor and how you’ve customized your home over the years, not all buyers will feel the same way about your design. That’s why it’s so important to make sure you focus on your home’s first impression so it appeals to as many buyers as possible. As NAR says:

“Staging is the art of preparing a home to appeal to the greatest number of potential buyers in your market. The right arrangements can move you into a higher price-point and help buyers fall in love the moment they walk through the door.”

Buyers want to envision themselves in the space so it truly feels like it could be their own. They need to see themselves inside with their furniture and keepsakes – not your pictures and decorations. A real estate professional can help you with tips to get your house ready to sell.

Bottom Line

If you’re considering selling your house, reach out to a local real estate professional to help you navigate through the process while prioritizing these best practices.